Macrs Life Flooring

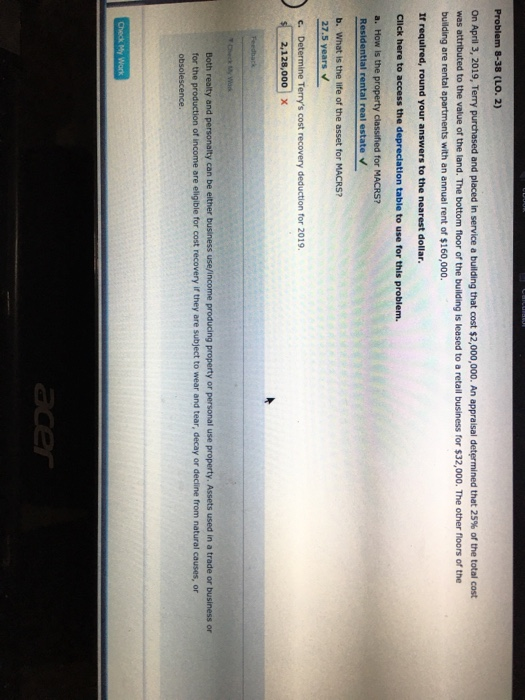

At the end of its useful life it is expected to be obsolescent.

Macrs life flooring. It is based on the idea that every asset has a useful life a period of time over which it remains useful and productive. Depreciation is a business tax deduction regulated by the internal revenue service irs. As such the irs requires you to depreciate them over a 27 5 year period. Most other types of flooring i e.

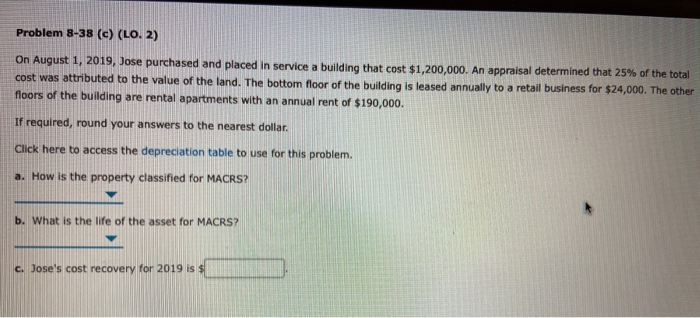

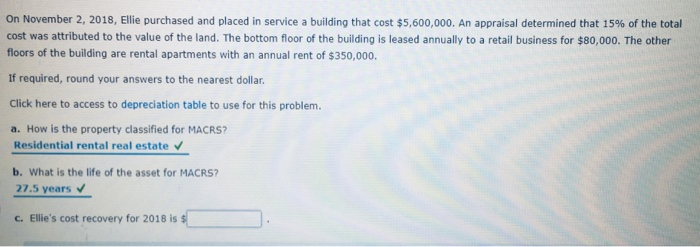

Increased section 179 deduction dollar limits. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property. Building or building component 39 years.

These types of flooring include hardwood tile vinyl and glued down carpet. Tile hardwood linoleum unlike carpeting are usually more or. Carpeting is depreciated over either five years or 27 5 years depending on how it is installed. If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

These types of flooring include hardwood tile vinyl and glued down carpet. Examples include ceramic or quarry tile marble paving brick and other coverings cemented mudded or grouted to the floor. Most flooring is considered to be permanently affixed. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.

Most flooring is considered to be permanently affixed. The maximum you can elect to deduct for most section 179 property you placed in service in tax years beginning in 2019 is 1 020 000 1 055 000 for qualified enterprise zone property. The depreciation period for flooring depends on the type you install. Most other types of flooring are depreciated using the 27 5 year schedule only.

Carpets are normally depreciated over 5 years this applies however only to carpets that are tacked down. I have a single family home i have been renting for 20 years. The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674. During 2019 i have made three major improvements to this house new flooring new windows and new plumbing worth 6 2k 8 8k 8 5k resp.

When i added these to my existing depreciation list the end result is that it s going to.